U.S. jobs data that bolstered expectations of faster rate hikes

5 November 2018 / Morning Brief

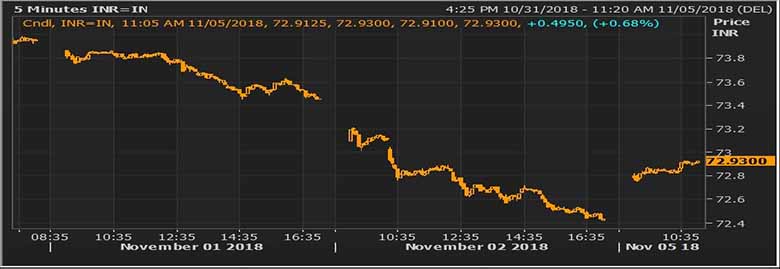

Indian Rupee

- The Indian rupee little changed at 72.80 pair now at 72.90 against 72.4350 previous close.

- Pair to tip in 72.70- 73.10 range today.

- Indian rupee opened weaker on Monday tracking Asian peers due to strong U.S. jobs data that bolstered expectations of faster rate hikes there. Dollar/rupee opened higher Monday on likely overseas fund outflows from local stocks amid global strength in greenback. Strong dollar and FII outflows from local stocks are supporting the spot pair. US NFP came strong and this would keep dollar strong.

Global Currency

- Indian rupee opened weaker on Monday tracking Asian peers due to strong U.S. jobs data that bolstered expectations of faster rate hikes there.

- The rupee is unlikely to fall sharply during the day as it is expected to take comfort from soft crude prices. Oil prices fell on Monday as the start to U.S. sanctions against Iran's fuel exports was softened by waivers that will allow some countries to still import Iranian crude, at least temporarily.

- The currency pair found bids in early Asian in response to a Sunday Times report stating that Prime Minister May has planned an all-UK customs deal with the EU, which would resolve the Irish border issue.

Global Markets

- Oil prices fell on Monday as the start to U.S. sanctions against Iran's fuel exports was softened by waivers that will allow major buyers to still import Iranian crude, at least temporarily. Front-month Brent crude were at $72.40 per barrel.

- Gold prices were steady in early Asian trade on Monday as the dollar eased, while investors are tuned in to the U.S. congressional elections on Tuesday. Spot gold was steady at $1,232.86 per ounce.

Global Markets at one Glance

| Markets Today | In INR | % Change | |

| USD/INR | 72.912 | 72.925 | 0.02 |

| EUR/USD | 1.13892 | 83.04 | 0.01 |

| GBP/USD | 1.29882 | 94.70 | 0.20 |

| USD/JPY | 113.269 | 0.64 | -0.06 |

| SEK/INR | 9.0609 | 8.0469 | |

| DKK/INR | 6.5085 | 11.2025 | 0.0325 |

| AUD/USD | 1.3901 | 52.45 | -0.03 |

| TIME | USD LIBOR | EURO LIBOR | |

| 1M | 2.31788 | -0.403 | |

| 3M | 2.59238 | -0.35457 | |

| 6M | 2.82888 | -0.32557 | 1Y | 3.10488 | -0.20971 |

| Index | Today | % Change |

| NIFTY | 10524.55 | -0.27 |

| SENSEX | 34963.24 | -0.14 |

| BANK NIFTY | 25693.25 | -0.03 |

| SGX NIFTY | 9347.5 | 0.33 |

| NIKKEI | 22243.66 | 2.56 |

| HANG SENG | 25836.86 | -2.45 |

| SHANGHAI | 2639.8544 | -1.37 |

| ASX200 | 5818.1 | -0.53 |

| DOW JONES | 25270.83 | -0.43 |

| S&P500 # | 2723.06 | -0.63 |

| NASDAQ # | 6965.294 | 0 |

| Key Events of the Day | |||||

| Date | Time | Currency | Event | Forecast | Previous |

| 05-11-2018 | 15.00 | GBP | Services PMI (Oct) | 53.3 | 53.9 |

| 05-11-2018 | 20.30 | USD | ISM Non-Manufacturing PMI (Oct) | 59.3 | 61.6 |