India Rupee Logs Weekly Fall As Budget Erases Fed-Led Gains

1 February 2019 / Evening Brief

Indian Rupee

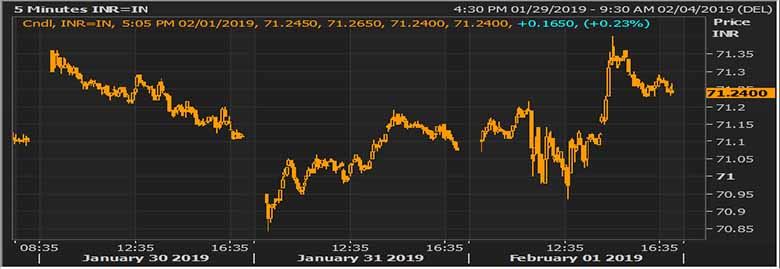

- The rupee settled at 71.24 against 71.0750 at the previous close. The local unit moved in 70.94-71.40 per dollar band intra-day.

- The Indian rupee posted a weekly decline against the dollar, after the nation’s continued fiscal slippage sparked concerns of foreign fund outflows, which outweighed gains from the Federal Reserve signaling a patient approach on future rate actions. However, the rupee trimmed some losses on suspected dollar sales by at least two state-run banks likely on behalf of the central bank. Market will remain focused on the monetary policy meet next week, while crude oil move will also be closely watched. he reaction of the market was negative for bonds due to gross and net borrowing numbers.

Global Currency

- Foreign exchange markets were mixed in early Friday trade in Europe, as tentative signs of progress in the U.S.-China trade war were offset by surveys showing more economic weakness in China and other Asian economies. The U.S. dollar index that tracks the greenback against a basket of other currencies was little changed at 95.31. The dollar had risen late Thursday on encouraging comments by high-ranking U.S. and Chinese officials, even though two days of trade talks had ended without any concrete agreement.

- The euro was little changed against the dollar at $1.1452, ahead of a string of PMI readings from across the region. It rose to 52.4 from 51.1 in December.

Global Markets

- Oil prices fell on Friday as the resolution of trade talks between the United States and China remained in doubt, and data from China stoked further concerns over an economic slowdown that could dent fuel demand.

- Gold prices were steady on Thursday, having earlier hit their highest in nine months, after the U.S. Federal Reserve kept interest rates steady and said it would be patient on further hikes.

Global Markets at one Glance

| Markets at 5.00pm | In INR | % Change | |

| USD/INR | 71.25 | 71.25 | 0.46 |

| EUR/USD | 1.14717 | 81.81 | 0.71 |

| GBP/USD | 1.30666 | 93.15 | 0.18 |

| USD/JPY | 108.868 | 0.65 | 0.42 |

| SEK/INR | 9.0396 | 7.8820 | 0.0374 |

| DKK/INR | 6.347 | 11.2250 | 0.49 |

| AUD/USD | 1.3773 | 51.78 | 0.37 |

| DXY | 95.477 | -0.11 | |

| Index | Today | % Change |

| NIFTY | 10893.65 | 0.58 |

| SENSEX | 36469.43 | 0.59 |

| NIKKEI | 20788.39 | 0.07 |

| HANG SENG | 27930.74 | -0.04 |

| SHANGHAI | 2618.2323 | 1.3 |

| CAC# | 4999.42 | 0.13 |

| FTSE # | 7264.61 | 0.0042 |

| DAX # | 11165.64 | -0.07 |

| Commodities | Today | % Change |

| GOLD # | 1321.01 | 0.03 |

| SILVER# | 16.022 | 0 |

| BRENT # | 60.85 | 0.02 | NYMEX # | 53.73 | -0.11 |

| Today | Today |

| OPEN | 71.1000 |

| HIGH | 71.4000 |

| LOW | 70.9400 |

| CLOSE | 71.2400 |

Key Events of the Day

| Date | Time | Currency | Event | Actual | Forecast | Previous |

| 01-02-2019 | 14.25 | EUR | German Manufacturing PMI (Jan) | 49.7 | 49.9 | 49.9 |

| 01-02-2019 | 15.00 | GBP | Manufacturing PMI (Jan) | 52.8 | 53.5 | 54.2 |